Best Of The Best Info About How To Get A Home Equity Loan

Enter your loan’s interest rate.

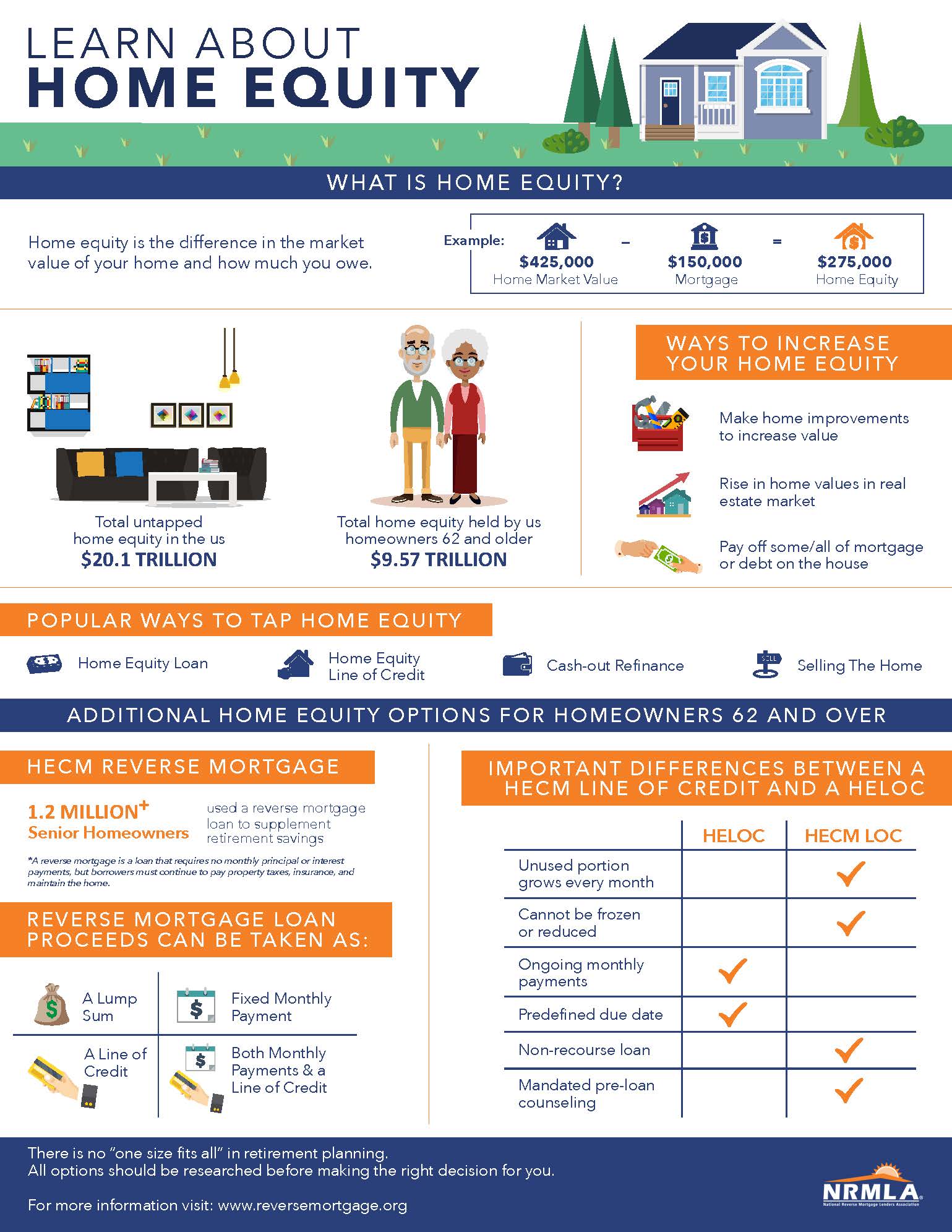

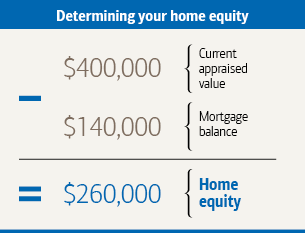

How to get a home equity loan. The more equity you have, the. A home equity loan uses the equity in your home—the difference between your home's current market value and what you owe on your mortgage—as collateral for the loan. 2 you can gain equity as you pay down your mortgage or as your home gains value.

The way you calculate home equity is simple: First, because the loan is secured by your home, you may be able to get a lower interest rate than you would for an unsecured loan. If you feel confident that you meet the minimum loan requirements, the basic steps involved in getting a home equity loan are as follows:

There are a few basic minimum requirements that you typically need to meet to qualify for a home equity loan, which include: This is the annual interest rate you’ll pay on the loan. If, for example, you took out a $450,000.

Second, you can use the money from a. While this type of loan can help borrowers consolidate. Compare top home equity loans and save.

Most lenders will want you to have at least 15% to 20% equity in your home both before and after the home equity loan. Calculate it by subtracting what you owe on your home from its current market value. You can get loan estimates from several different sources,.

Home equity loan and line of credit (heloc) rates rose a bit this week. A home equity loan offers a fixed rate, while the rate on a home equity line of credit is variable — or based on an index plus a margin. Home equity loan rates are between 3.5% and 9.25% on average.

It's a good idea to. When you apply for a home equity loan,. Ad reviews trusted by 45,000,000+.

Don't wait for a stimulus from congress, refi before rates rise. How to get a home equity loan apply with several lenders and compare their costs, including interest rates. You may be able to borrow up to 80% of the equity in your home through a home equity loan or line of credit but to do that, you must first have a good amount.

If your home’s value increases to $1 million after 10 years — the. Typically, heloc rates move in step with rate increases by the fed. The best home equity loan lenders excelled in areas that are historically important for this group, including speed, low lender fees and low interest rates.

So, for example, if your home is currently worth. Home equity loans are second mortgage loans that you pay off with monthly payments, just as you do with your primary mortgage. Home equity loans allow homeowners to access as much as 80% or 85% of the equity in their home as a lump sum.

:max_bytes(150000):strip_icc()/dotdash-home-equity-vs-heloc-final-866a2763fd0548eaa393afa0ffd7372b.jpg)

:max_bytes(150000):strip_icc()/dotdash-mortgage-heloc-differences-Final-6e9607c933e9467ba4d676601497a330.jpg)

:max_bytes(150000):strip_icc()/dotdash-INV-infographic-Home-Equity-Loan-v1-9ae3dc9a5cc141d5a25ed2975c08ea1c.jpg)