Outstanding Info About How To Reduce Credit Card Balance

Write down a debt summary that includes the creditor, monthly.

How to reduce credit card balance. According to credit rating company experian, if. Say you have a credit card balance of $4,000 and will be. Some credit card companies offer a low or 0% introductory apr for a limited amount of time, which will.

Paying more than once per month — say, every two weeks — will reduce that average balance and, with it, your interest charges. “one way to lower your monthly credit card bill is to open a new card with a 0% apr for an introductory period, and transfer your existing credit card balances to it,” said davis. Make a budget that will help you pay down your debt.

How to tackle high credit card balances by latoya irby updated on september 21, 2021 reviewed by pamela rodriguez fact checked by david rubin in this article the cost. If you have several credit cards, try to pay off the one with the highest. Pay down your credit card balances.

First, by closing the credit card you will no longer be able to use the card to make. Only use your credit card for a purchase that you can already afford to pay for in full. The debt snowball method focuses on paying off credit card debt from the lowest to highest.

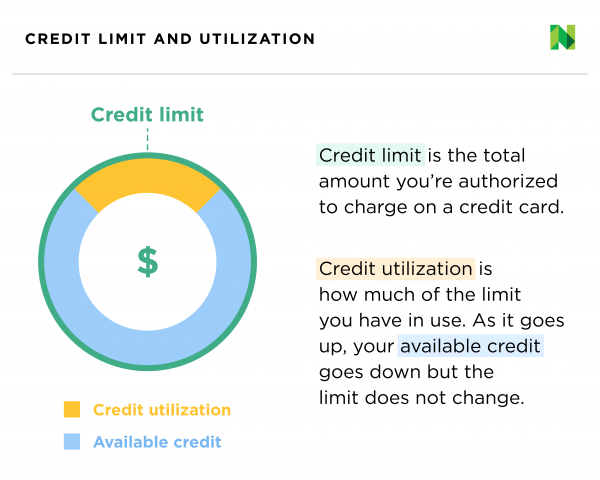

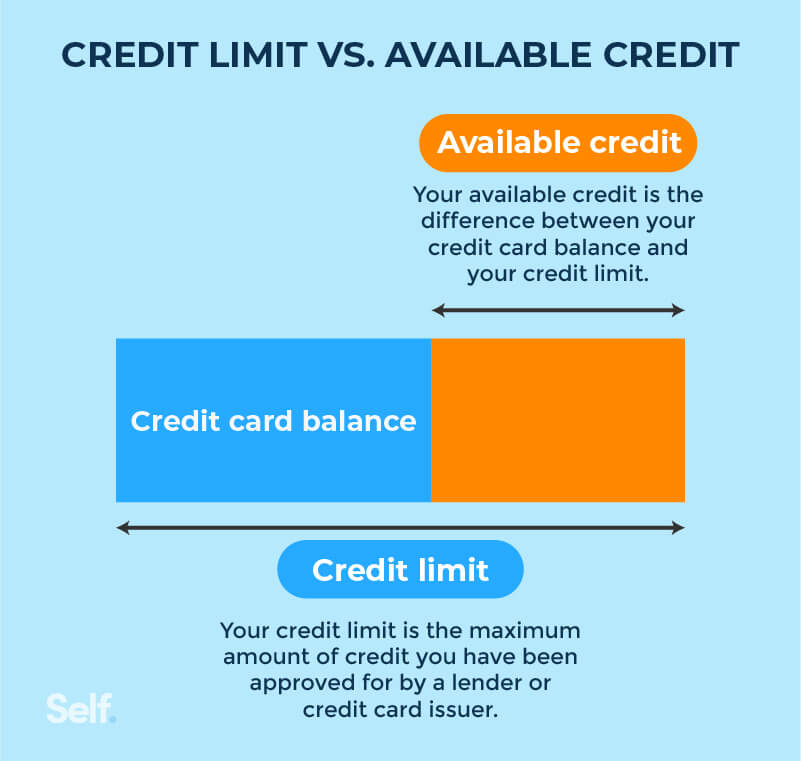

There are two ways to lower your interest rate call the credit card issuer and ask for a rate reduction. Then, mentally set that money aside for the upcoming credit card bill or even pay the. The simplest way to lower your utilization rate is to pay down your.

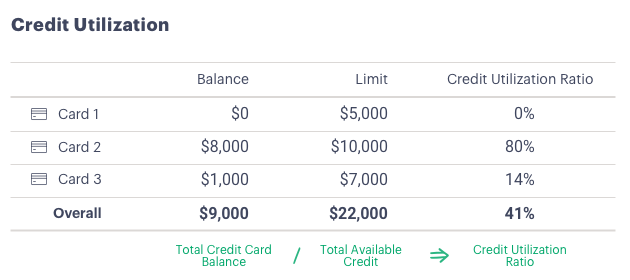

There are several ways you can lower your credit card utilization rate. 2 days agowhile 30% or less credit ratio is the general guideline, those who want excellent credit scores will need to keep it even lower. Here are 10 tips for reducing credit card debt in 2014:

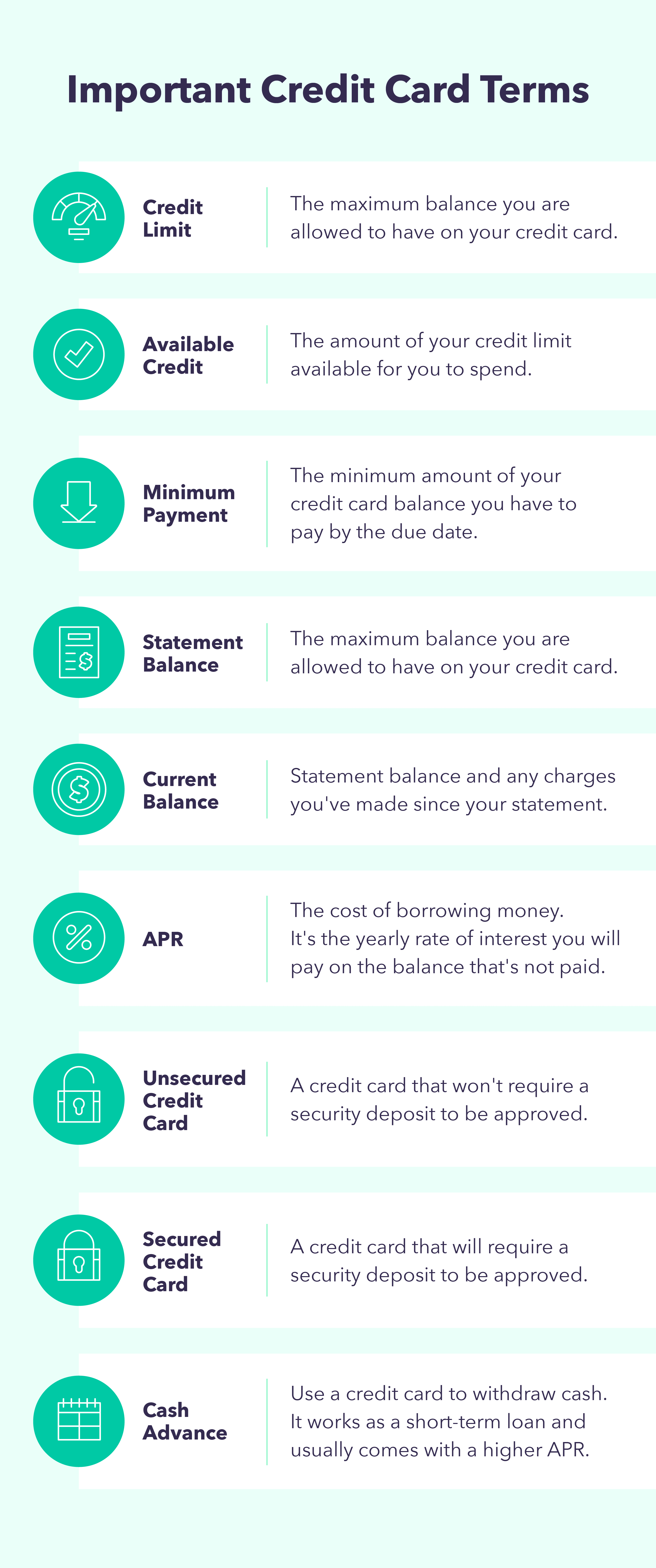

This refers to the percentage of total available credit that is in use across all your card accounts. If you've been a good customer, consistently pay on time, and have a. The interest on your april purchases will be charged starting on the transaction date of each purchase.

Say you owe $2,000 on a credit card with a 20% apr and a $40 monthly minimum payment. Using a balance transfer might be a good way to reduce your debt. Start with the highest interest rate first.

Other ways to lower your credit card interest rate. For example, say you have three credit cards with. Balance transfer as an alternative to a lower rate for credit cardholders facing carried balances with high interest rates, a balance transfer card option may help reduce a rate.

You'll make minimum payments on all of your balances except for the lowest. You can apply for a balance transfer credit card with a 0% introductory apr offer. You can close a credit card with a balance, but there are a few things to keep in mind.

:max_bytes(150000):strip_icc()/credit-limit-definition-960695-v1-82b65d7e2653423cb55f871b05a0ccf1.png)

:max_bytes(150000):strip_icc()/pros-cons-personal-loans-vs-credit-cards-v1-4ae1318762804355a83094fcd43edb6a.png)

_1.jpg?ext=.jpg)